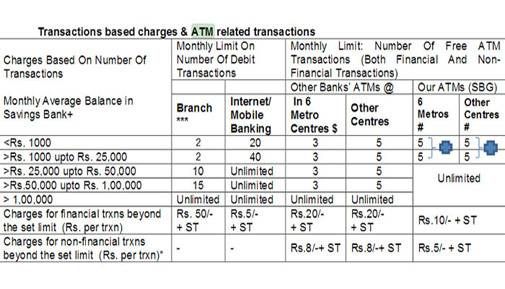

India’s largest lender, State Bank of India has brought slew of changes hiking various service charges & levying penalty on non-maintenance of minimum monthly average balance (MAB). The banking giant ( Customer base of 37 crore after the merger) decided to charge Rs 50 for each transaction beyond the free transaction limit,plus service tax. The MAB requirement which was Rs 500 ( without cheque book) & Rs 1000 (with cheque book) across the country till 31 march, has been now hiked manifold.

SBI has now fixed separate MAB of Rs 5000 for ‘metro’, Rs 3000 for ‘urban’, Rs 2000 for ‘semi-urban’ and Rs 1000 ‘rural’ areas respectively. Non-maintenance or breach of this MAB will invite penalty ranging from Rs 20 (rural branches) to Rs 100 (metro cities) for SBI savings bank account holders. The penalty is as high as Rs 500 for current account holders.

This draconian move of hiking charges evoked massive public outrage with customers protesting on social media with hashtags like #NoTransactionDay #BanksVsCommonMan

Coming under the surveillance of SBI’s CCTV camera may charge a customer rs10/min. As this will increase sbi’s HDD storage #NoTransactionDay

— Abhishek Bhardwaj (@SereneAbhishek) April 5, 2017

As log as SBI has support from RBI and the guv, no matter how many no transaction days we have, it will not matter to them #notransactionday

— Kalyan Vemuri (@klynvemuri) April 5, 2017

And widespread whatsapp msg circulation calling for SBI boycott on 6th April as a mark of “Show of Strength” or to make them experience public power. Dont know how fruitful was the boycott appeal today but these change in SBI rules & regulations are very much questionable.

What have the SBI authorities planned for students & daily wage earners as it would be very difficult for them to maintain the required MAB ? Is SBI not answerable to its esteemed customers ? Should SBI not clarify how will hiking charges benefit individual customers? Whenever such arbitrary decisions are taken, Only the common people have to bear the brunt.

More than anything else, SBI did not even spare net banking from making chargeable that too at a time when govt aggressively promoting Digital India,Cashless Economy,Digital Payments in the form of Digi-dhan melas,launching Lucky Grahak Yojana, Digi-dhan Vyapar Yojana etc.

However, If one maintain 25,000 or 100000 in his or her SBI savings account, then the customer can use ATM unlimited number of time & restrictions on number of transaction will be less . Charge exemption for the rich while bulldozing the poor ?

Oh wait, SBI is yet to recover thousands of crores from wilful defaulter like Vijay Mallya & there was even reports of SBI delisting Vijay Mallya’s 1200 crore loan from accounts book.

During the net neutrality debate, following massive public outrage, TRAI & the Govt snubbed telcos theory of diferential pricing & victory was ours. Here also we need the same spirit to make ourself heard by the Govt & RBI.

We have to change bank. Why is SBI rulling authoritative force to the honest customer instead of Bijay Malia. They can’t grant micro loans to the honest poor people but can provide thousands of crores to nasty Bijay Malia.

LikeLiked by 1 person

Exactly bro,customers should also have a say on SBI policy making

LikeLike